November 19, 2020 · Chad Anderson

Business aviation’s resilience clear as pre-owned transactions set to grow over next five years

This month we are releasing our 5-Year Pre-Owned Business Aviation Market Forecast. With the impact of Covid-19 touching many lives and industries, including our own, forecasting the future has certainly been more challenging against this backdrop. However, it doesn’t mean we shouldn’t attempt to do so.

This month we are releasing our 5-Year Pre-Owned Business Aviation Market Forecast. With the impact of Covid-19 touching many lives and industries, including our own, forecasting the future has certainly been more challenging against this backdrop. However, it doesn’t mean we shouldn’t attempt to do so.

This year, we are focusing our predictions solely on the pre-owned market, an area often excluded from other industry outlooks and which is a particular strength of ours. Moreover, for the first time, our forecast is enriched by the introduction of trends from our own past transactional data and customer insights.

In our previous forecasts, we did predict a downturn. Although it has taken place sooner than we thought, we were prepared and, as a result, are in a stronger position than 2008, the last big downturn for our industry.

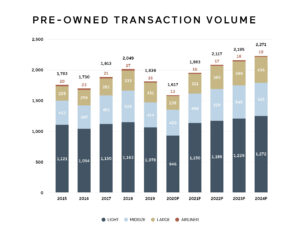

During the five-year period we will see pre-owned transaction volume and value recovering to steady growth, despite the challenges of this year, reaching 2,271 pre-owned transactions worth $11.1B annually by 2024.

During the five-year period we will see pre-owned transaction volume and value recovering to steady growth, despite the challenges of this year, reaching 2,271 pre-owned transactions worth $11.1B annually by 2024.

Business aviation is resilient, and our forecast shows it has begun to stabilize from the effects of Covid-19 as more people realize its value. Furthermore, trends in international trade activity bode well for industry growth. According to the World Trade Organization, trade volume is expected to rebound in 2021. Another key driver in business aviation transactions is the increase in the number of ultra-high net worth individuals (UHNWIs), which is set to grow by 5% per annum until 2024.

Drawing upon nearly 60 years of industry knowledge, this is the first year we are incorporating our own past transactional data and customer insights into the forecast, delivering a unique look at buyer behavior. Our data shows Large Jets representing a strong share of purchases by younger buyers, and that High Net Worth buyer types are more likely to invest in this aircraft segment as compared to Corporations and Governments. These trends, coupled with the predicted increase in worldwide UHNWI population, truly demonstrate the potential of the Large Jet category, which remains poised for long-term growth.

On behalf of the team at Jetcraft, I am honored we have had the opportunity to produce another annual forecast this year to support the future of our industry. In this climate, it is increasingly important for us to come together to share helpful insights and information.

As always, we welcome your comments, questions and feedback.

To download the complete 2020 5-Year Pre-Owned Business Aviation Market Forecast, visit https://www.jetcraft.com/knowledge/market-forecast/.

SIGN UP FOR OUR MONTHLY JETSTREAM RECAP

Don't miss future Jetstream articles. Sign up for our Jetcraft News mailing list to receive a monthly eblast with links to our latest articles. Click to join the 1,800+ subscribers on our mailing list.